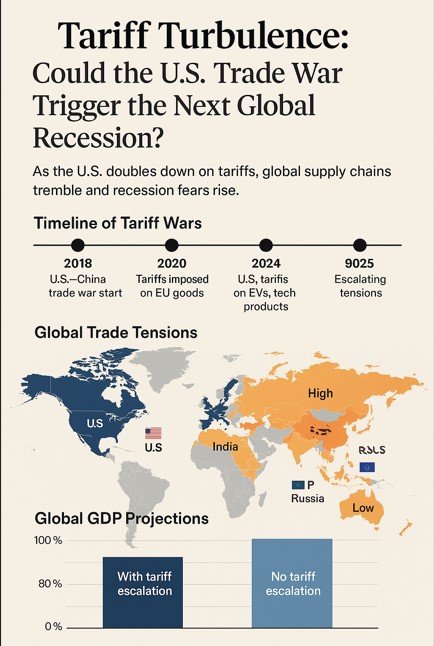

Tariff Turbulence: How the U.S. Trade War Could Trigger the Next Global Recession

- Breaking NewsBusinessHEADLINESNATIONOpinion

- April 10, 2025

- No Comment

- 32

Saptrishi Soni:

Imagine waking up to find that everything—from your morning coffee to your smartphone—has suddenly become more expensive. This isn’t a dystopian future, but the reality looming over the global economy, as tariff wars intensify once again, with the United States leading a new wave of aggressive trade actions that threaten to destabilize international markets.

From Washington to Beijing, Brussels to New Delhi, governments are bracing for economic tremors stemming from tariff hikes and retaliatory taxes. The Biden administration, despite advocating multilateralism, has carried forward key protectionist measures from the Trump era—and in some cases, escalated them under the banner of national security and fair trade.

But what does this mean for the rest of the world? And could this escalating trade tension tip the fragile post-pandemic recovery into another full-blown recession?

Tariffs: Economic Tool or Political Weapon?

Tariffs—import taxes levied by governments—were historically designed to protect domestic industries, generate revenue, and manage trade deficits. But in recent years, they have transformed into powerful geopolitical tools. The U.S.–China trade war (2018–2020) was a prime example, when both nations imposed hundreds of billions in retaliatory tariffs.

Today, that fire hasn’t died—it’s been rekindled. As the U.S. targets foreign goods and countries strike back, the global trade order risks being fractured anew.

Recent moves:

-

U.S. tariffs on Chinese tech goods remain in place and are now being expanded to include EV batteries and solar components.

-

Proposed taxes on digital services in Europe and India have drawn retaliatory threats from the U.S.

-

Tensions over carbon tariffs, especially from the EU, are also escalating with American exporters fearing future penalties.

The Domino Effect on Global Supply Chains

Tariff hikes don’t occur in isolation. They send shockwaves through global supply chains. Multinational companies face rising production costs, delays, and a scramble to diversify sourcing.

Consider this:

-

U.S. tariffs on semiconductors and rare earths sourced from Asia have made manufacturing costlier, affecting sectors like automotive, consumer electronics, and defense.

-

China has responded by restricting exports of graphite and gallium—key minerals for tech hardware.

-

Major firms are now reshuffling operations from China to Vietnam, Mexico, and India to minimize exposure.

While such shifts may seem like opportunities for emerging markets, they come with short-term disruptions, higher prices, and uncertainty.

India, the EU, and Other Fronts in the Trade Dispute

India, for instance, has been on both sides of tariff battles with the U.S.—particularly over agricultural exports, pharmaceuticals, and digital taxes. Washington has raised concerns over India’s tariffs on American goods like almonds and apples, while New Delhi has criticized U.S. visa restrictions and export duties on steel and aluminum.

The European Union, too, finds itself in a tight spot. The long-running Boeing-Airbus subsidies dispute and the imposition of U.S. tariffs on European wine, cheese, and aircraft parts caused significant economic strain. With growing differences over carbon border taxes and the digital economy, the U.S.-EU trade relationship remains vulnerable.

WTO: A Watchdog with Blunt Teeth?

As trade tensions escalate, the role of the World Trade Organization (WTO) is under scrutiny. Designed to mediate disputes and uphold free trade, the WTO’s influence has waned due to the refusal of the U.S. to support its appellate body, effectively paralyzing its dispute resolution mechanism.

With global giants bypassing the WTO and opting for bilateral retaliation, the rules-based trading system risks further erosion. This weakening of international trade governance could encourage more countries to act unilaterally, exacerbating tensions.

The Real Threat: Global Recession 2.0?

The biggest risk of ongoing tariff wars isn’t just higher prices—it’s the prospect of another global recession. Here’s how:

-

Consumer Spending Falls: As imported goods become expensive, purchasing power drops, slowing consumption.

-

Investor Uncertainty: Volatile trade policies deter investment and long-term planning.

-

Stifled Innovation: Industries reliant on cross-border tech collaboration face barriers, impacting innovation cycles.

-

Agricultural Pain: Countries dependent on exports (like Brazil, India, and the U.S. Midwest) face lower demand and price drops.

Global financial institutions, including the IMF and World Bank, have already cautioned that prolonged tariff escalations could shave off nearly 1% of global GDP growth annually—a staggering figure in a post-pandemic recovery phase.

A Way Forward: From Protectionism to Pragmatism

Despite rising protectionist rhetoric, there is still room for global course correction. A few encouraging trends include:

-

The push for new trade pacts like the Indo-Pacific Economic Framework (IPEF) and EU-India FTA negotiations.

-

Revival of regional economic alliances like RCEP and CPTPP to build alternative trade routes.

-

A renewed global focus on sustainable trade—including tariff relaxations on green technologies and environmentally friendly products.

But these alone won’t suffice. For long-term stability, the world must return to multilateral dialogue, restore trust in institutions like the WTO, and balance domestic economic needs with global cooperation.

The Tariff Trap We Must Avoid

What began as a strategy to protect jobs and reduce trade deficits now threatens to derail global economic recovery. The U.S. may be leading the charge, but no nation is immune from the fallout of trade conflict.

As tariff walls rise, so do the barriers to progress, equity, and cooperation. If left unchecked, this tariff war could become the spark that lights the next global downturn.

The world stands at a crossroads: regress into economic isolation or rebuild a future founded on mutual growth. The choice—and the cost—is ours.